Your tech company valuation and informing your approach to growth: Think about your milestones carefully

Valuing your tech company isn’t easy. There is a lot to consider in order to value your software or tech company properly. It’s hard to do as no two companies are the same. For example, growth rates, customer concentration, retention, business model, competitive landscape and management team will all come into play. Not an all-inclusive list, and if you’ve attended any of Corum’s events, a properly run sales process is the best way to determine your company’s value. Different buyers will see your business from different perspectives and therefore value it differently. What problem do you solve for a buyer? What type of buyer is it? Strategic or PE? Is the PE rolling up a sector, therefore, really a strategic buyer? Are the buyer’s customers asking for the type of technology that you’ve created? Complex.

It’s much more than a spreadsheet, though. And, if I may be provocative, choosing when to sell your company is a function of the need for knowledge, not the math. In other words, deciding to enter the market based on a speculative valuation may not be good enough. At the end of the day, the numbers are the numbers – like gravity. You can sit in your virtual board room and try to triangulate on a valuation based on pre-process theoretical motions, but you really won’t know until you talk to the market. More importantly, a pre-process valuation number may be less important than gaining an understanding of what you need to learn about the business’s position in the market and the associated value relative to an exit. What do you need to know about how to scale the business? How do you keep growing in fast-moving tech waters? These are the broader questions worth considering. At the end of the day, the larger businesses have the same problem: how does the business keep growing to stay relevant. They likely have a larger balance sheet or have figured out how to access capital efficiently, but they still have to get and retain customers faster than the competition.

Many factors are going to impact your valuation. The stage that the business is at, market trends, what you do for your customers, organization make-up, financial conditions and who the buyers are will all be part of the equation. Let’s look deeper at these aspects below and keep in mind that market timing likely has little to do with what the

stakeholders believe the value of the business could be in a vacuum. Since our competitor sold for X, we too should get X. The good news or bad news depending on where you sit, is that your value is not determined in this way. It’s not a straight path.

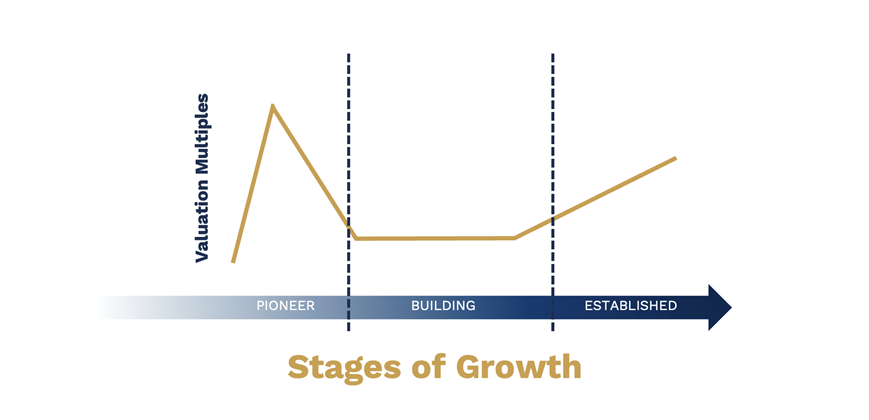

Stages of Growth:

Businesses go thru cycles, as shown below. Where are you in the evolution of your business? Are you a “20-year-old start-up”? Have you recently pivoted? Are you trying to add functionality that will help you grow your customers or land and expand your current client base?

Within the continuum illustrated in the chart above, a business moves thru being, becoming, progressing and sometimes regressing from a great idea, great technology, great product, great business. Product-Market-Fit. Always moving, never stagnant and sometimes elusive. I’ll ask CEOs why they are growing, and often I hear, “we finally figured out how to sell the product.” The graphic above is important to consider nonetheless as you want to understand where your business is on this continuum realistically.

Technology Trends Shaping the Market:

What is happening in the market? Where are the trend lines? Where is the puck going? Every year, Corum leverages our unique vantage point in the marketplace to develop the Top 10 Disruptive Tech Trends that we see driving deals in the coming year. We synthesize the thousands of interactions with technology companies and entrepreneurs through our educational events and our thousands of conversations with buyers for our clients into the leading list of its kind every year. These are the trends that you want to understand as a CEO considering the tech M&A market today because they are shaping the tech M&A environment.

The disruptive trends create the change that drives strategic imperative for buyers—if you aren’t properly positioned in regard to those trends, you’re going to have a much harder time getting optimal value for your company. Well-positioned companies, though, get sold.

We’ve divided the Top 10 Disruptive Tech Trends into “Foundational” trends, those technology and societal trends that are changing things at a very basic level, and “Functional,” specific ways foundational and other trends play out in particular markets and technologies. It’s at the intersection of two or more of these trends where things get very exciting, and if you attend our Merge Briefing, we go into more details on these trends.

What does your product actually do for your customers?

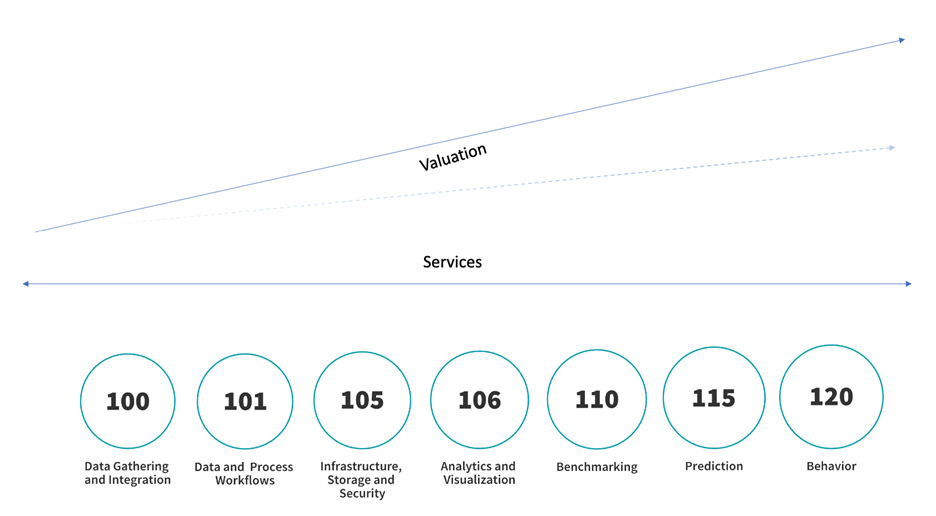

The macro conditions in your sector, economic conditions overall, and where your company is on its journey are all going to play a role in determining your company's value. And, as you’ve seen in Corum’s Top 10 Disruptive Tech Trends, different sectors will be hotter than others as tech trends play out and you try to ride these waves. What you actually do for your customers will have a dramatic impact on your valuation, though. Look at the IoT sector as a germane example. Are you gathering data with IoT devices, creating workflows or providing ways for users to visualize data? What your customers use your product for can have a dramatic impact on your valuation in the market. We’ve seen the commoditization of markets essentially overnight as companies look for ways to have an impact in a specific sector.

The graphic below represents the delicate balance and continuum between value and what your customers use your product to do. The point is not the numbers, but that the weight of the numbers will be dependent on the mission criticality of your product for your customers and what problems your product solves for your customers.

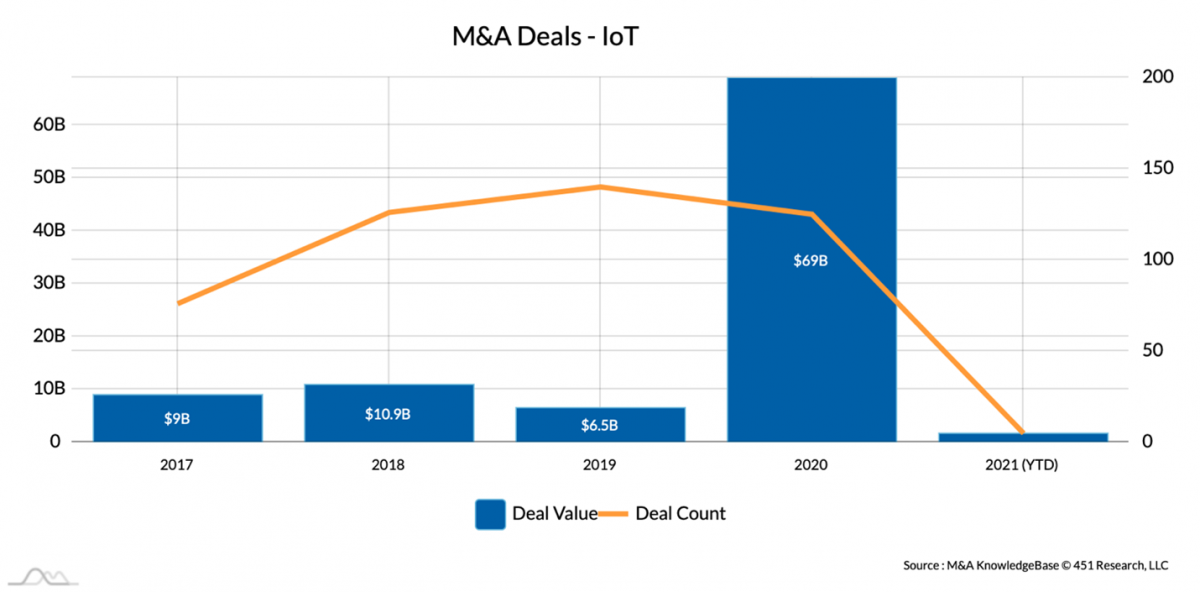

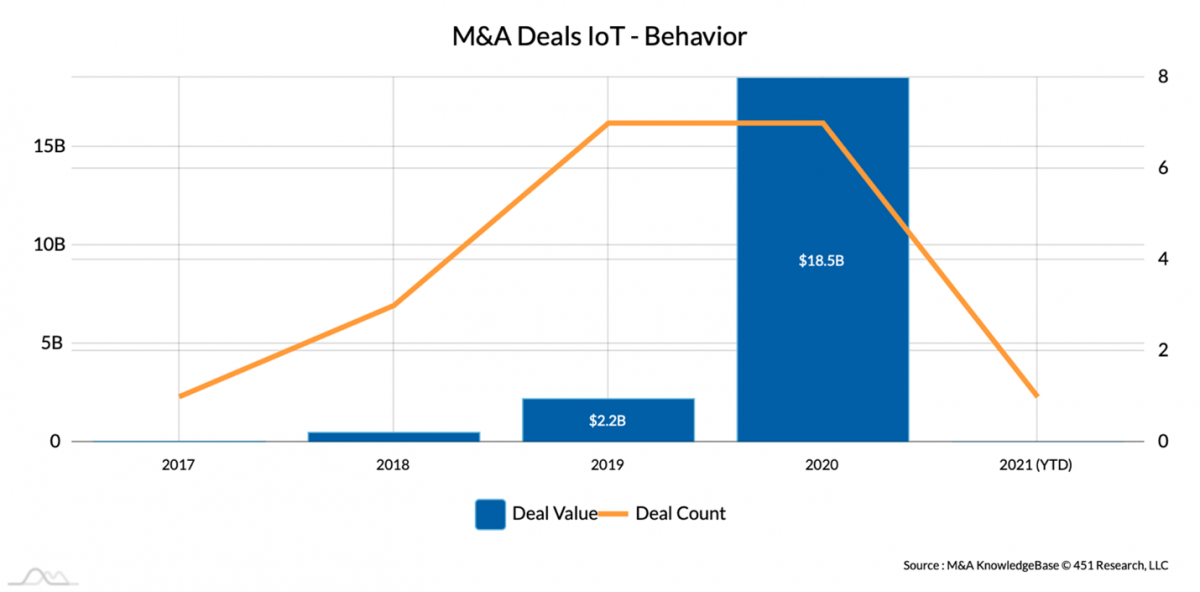

In the chart below, look at the deal volume and valuations in the broader IoT sector over a longer-term period as an example. While we saw a dramatic increase in the number of deals in the last few years, the value of the deals was at all-time high levels in 2020, interestingly enough.

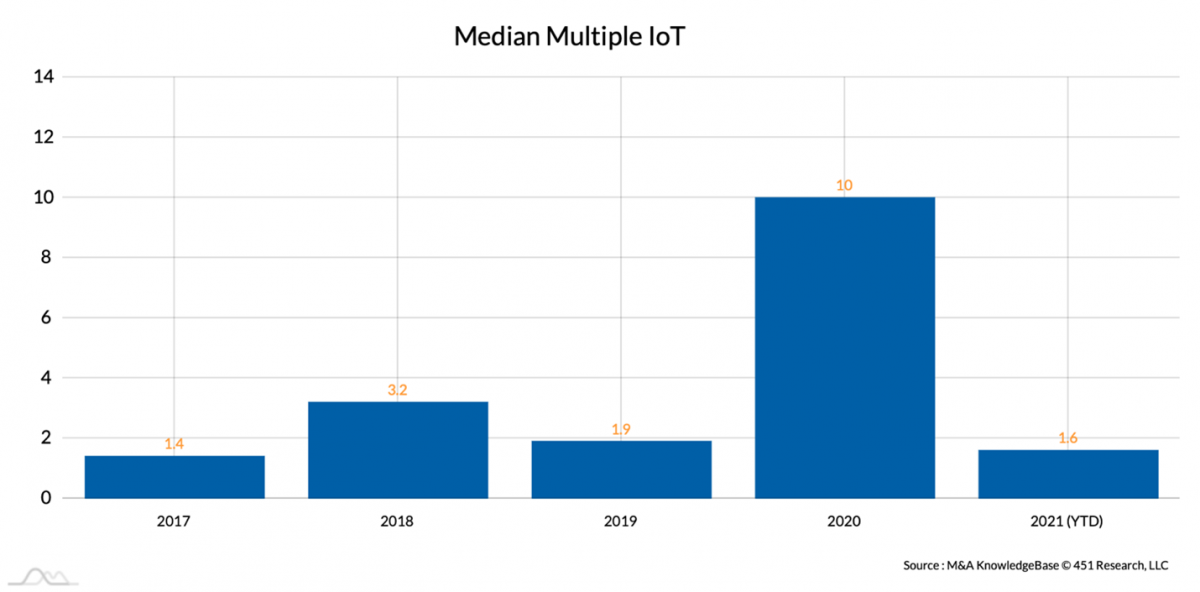

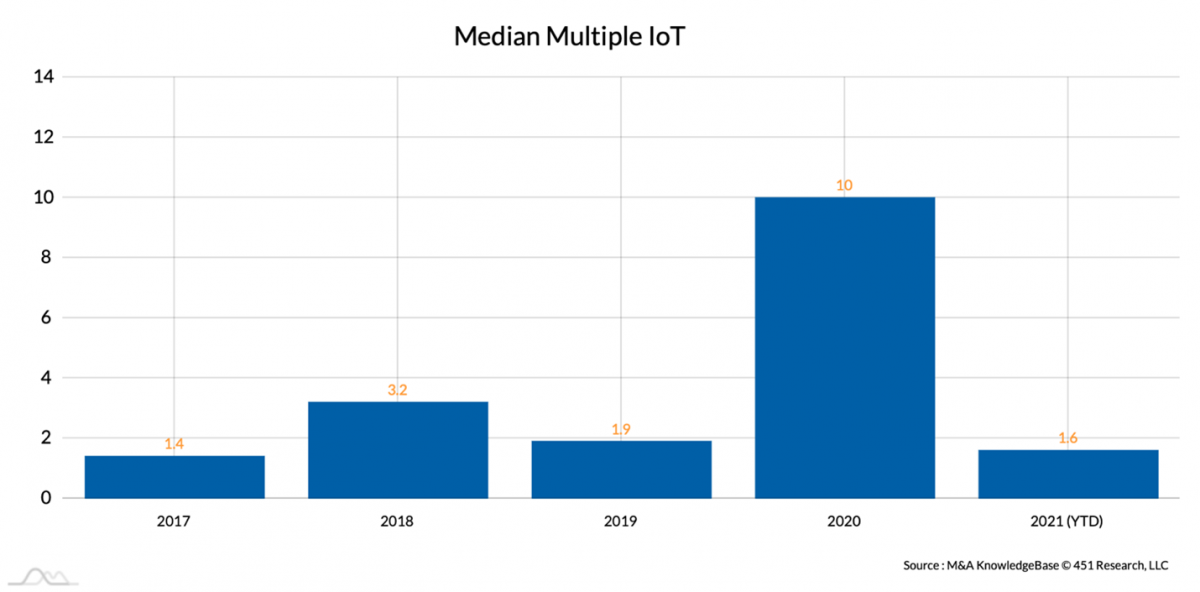

Median deal values were also up in 2020 as well at 10X revenue.

If you double-click on the IoT sector and look at deals that thematically included a behavioral component, the median valuations were higher. Again, what your product does for your customers will impact the valuation of the business.

Drivers of Valuation:

Additional factors below will have an impact on how your business is valued. Understanding the market dynamics is critical. How many competitors, how big is the TAM, SAM and SOM and how easy your product can be replaced are some of the drivers when you look at the market you are playing in. Further, the organization elements, including the team, the product and your go-to-market, are other aspects that are considered when valuing your business.

Of course, your business’s financial metrics and will be heavily analyzed to determine the trends underpinning your business from a financial standpoint. ARR, MRR, CMRR, growth rates, revenue recognition and business model, will be important in the buyer’s eye to determine fit and the health of the business.

Business Model:

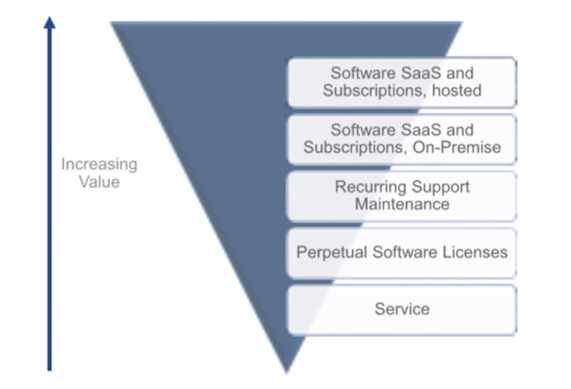

Your business model matters. As discussed in our Quality of Revenue whitepaper, the way you charge your customers for your products will have an impact on your business valuation. As an example, subscription-based pricing versus a license maintenance model will impact how a buyer values your company. Cloud-native businesses versus on-prem businesses will see different valuations as well. If you’re considering moving your business to the cloud, consider the timing and impact on a potential sales process for your business. I had a client utilizing a proof-of-concept enterprise model (Try on a limited basis and then upon success deploy to the rest of the organization) for their business model and their valuation was around 1X revenue. They moved to a SaaS model and their valuation shot up to around 7X revenue.

The reverse pyramid below shows the relationship between the type of revenue and valuation. Suppose you have multiple business models within your company, some buyers may value the different components differently or ignore some revenue streams completely as they focus on what streams are important to them.

What are your Expectations:

Such a dangerous question to answer when talking to investors or acquirers of your company. Most buyers and investors will ask you this question. I recommend not answering this question as there are many components that would typically make up your expectations and other drivers of your valuation. But, more importantly, are your expectations realistic? Are they unrealistic? What are they based on? With so much of your wealth (and life’s work) potentially tied up in one asset, figuring out how much you are going to get out of a potential sale is something that shouldn’t be guessed at or substantiated with uninformed information.

Also, your expectations shouldn’t be based on what you need to retire or the need for F.O. money. I’ve seen this come up often, and, in these situations, separating the needs of the CEO from the business is critical. I talk about this in another article I wrote called Getting The CEO Ready.

Growth:

Further, it’s hard to change the growth trajectory of your company as well as the business model of your business. Not only is calibrating the market a necessary step in your company’s journey, but it will also be humbling and eye-opening. Today, one of the most heavily weighted aspects of how a buyer will value your business is your growth trajectory. Both historical growth and future growth are critical determinants of valuation. Are you a 20-year-old business that has grown a few percentage points a year, or are you a fast-growing company growing at 30 to 50 percent a year? Also, compound annual growth rate (CAGR), while interesting, is not a typical metric that buyers will rely on. Buyers are buying you for what they can do with the business in the future, so run rates and forward-looking forecast credibility are much more relevant.

Beware of incrementalism as well. Believing that the new contract you signed with the billion-dollar strategic or the new product you’re getting ready to launch will miraculously have an instant impact on your valuation is risky. Product launches typically take longer to materialize and adding new features typically won’t significantly impact your valuation in the short term.

Who is the buyer, and how do they buy?

Despite all of the factors discussed herein, the specific buyer’s playbook will heavily drive how they will value and structure a deal. Buyers often won’t share their methodology for valuing your business. Some buyers will only pay 1-3X revenues no matter what your business is and how it is performing. Or some will say that they’ll never pay more than their share price, unless it is strategic. It is also important to understand what the total addressable market is within the buyer’s customer base and how they see their TAM as well. While most buyers will determine enterprise value on a case-by-case basis, understanding how a buyer views enterprise value is important to get on the table as soon as possible.

A properly run global process will also weed out the tire-kickers. Curious, interested, excited and pre-emptive. Understanding where a buyer lies on this continuum is also critical. Make sure the buyers are properly qualified along the way, so you don’t waste time.

However, once you understand where a buyer is along the C.I.E.P. continuum above, their valuation usually is a corollary. Hearing “this won’t break my year if we don’t acquire this company” from a buyer versus “your product is critical to our growth strategy for this business unit” will help you understand where you sit on the radar for a buyer or investor.

Closing Thoughts

A properly run global sales process is going to force you to think about your business differently. Get you out of your echo chamber. Moreover, look at your business thru a global lens that may not be present in your board room or bedroom (your partner is your sounding board). Over and over again, I see CEOs get excited about having others to talk to in an acquiring company or growth investor for benchmarking and best practices. You’ll no longer be in the vacuum of having to make all of the decisions yourself without talking to others active in a given sector.

Selling your business is a question of what you need to know now to grow your company. Yes, enterprise value is important, but the broader question is how you inform your strategy to get the business to the next level.