Getting the CEO Ready

Deciding when to sell your software or technology company can be daunting. Weighing “How much am I worth?” and “When should I enter the market?” will likely be a constant see-saw in your head ― always there, probably never going away. Balancing this puzzling task with its variables and the day-to-day needs of the business is hard. Preparing to sell your company is a topic we cover in our Selling Up Selling Out conferences. If the CEO and the team are prepared, you send an important message to buyers and valuations will typically be higher. But what does being prepared and ready mean? Let’s peel this back further. What does it take for the CEO to be ready to sell a company and lead it through a sales process? I’ll dive into some areas that go deeper than setting up your data room.

It’s not about you

Talking to CEOs on a regular basis, I often hear the savvy CEO tell me that that they don’t need the money, so there isn’t a need to sell the company. I usually smile when I hear this and ask a simple question: “Do you realize that the needs of you as the CEO are no longer the same as the company’s?” Blank stares aside, you should understand that you are no longer the company. The diverging needs of the CEO and the company can lead to conflict. Clear and present danger. Sure, when you start the company, the CEO and the company may be one. However, as the company grows, it has different needs than the (ego-centric) CEO. The faster the divergence, usually the faster the company is growing. Separate your needs from those of the company. What you want as CEO may not be in the best interest of the company. As with a child, if you don’t nurture it with what a child requires - which may contrast from what an adult needs-you can stymie the child’s growth. Your company is no different. As it evolves, it will have different needs than the CEO. Recognize that early on and you’ll be able to provide the proper fuel to grow the business.

The role of your board

Choosing your board is one of the most important steps you will make in preparing your company for sale. Some CEOs may not have a board, some may rely on their significant other, some may have a board of non-technical executives and some may have savvy technology investors. If you’re lucky, you may have a hybrid of all of these people helping you steer the business. Your board members will play differing roles throughout the evolution of your business and what their role will be when it comes time to sell the company will vary. When that time comes, there may be a board member who thinks they can run a sales process.

Using a board member to run the sales process is fraught with risk. Not only could a conflict of interest arise, the board member may not have the skills and resources necessary to run an effective process. Having sold their company in the past is not an out-of-the-box qualification to have them try to sell your company. Running a sales process requires a carefully coordinated global search as well as a full team. Your board member may have had a great exit and run a successful company, but that doesn’t qualify them to sell the company where they are a board member. Conflicts aside, a board member trying to run a process that doesn’t include a global buyers list and an understanding of the buyer’s processes could lead to lackluster results. Another risk is that the board member is drinking the Kool-Aid when it comes to valuation. Deals can fall apart when negotiating the company’s valuation during the LOI phase, or during due diligence, or when convincing the board of the acquiring company that they should complete the transaction during due diligence. Remember, nothing good happens from the time you sign an LOI to the time that you close the deal, and you are in the beginning of the last period (or top of 7th inning or beginning of the 4th quarter if hockey isn’t your sport) when you enter due diligence. The game is far from over. If a board member is not closing transactions regularly, there will be higher risk in getting the deal over the finish line.

Product-Market Fit

Understanding your growth trajectory and the drivers of your business is a critical element of a CEO’s work. Changing growth trajectory is hard. Imagining that the one new product in the pipeline will be the silver bullet is a risky proposition; new products often rollover to become new features that are hard to monetize at scale (beware of incrementalism). Believing that the new channel partner will suddenly support the hockey-stick growth you’ve been telling your investors about is equally dangerous.

There is a difference between a good idea, a good technology, a good product and a good company. Companies can be sold along any of these points as long as you recognize what you’re selling. As the CEO, you have to discern where your company is in its evolution and that the company is the product in this case, and different than products you sell to your customers. Moving between these paradigms is challenging and in the evolution of your company, it is not uncommon for you to stop growing ― how often have you referred to your business as a 20-year-old start up?

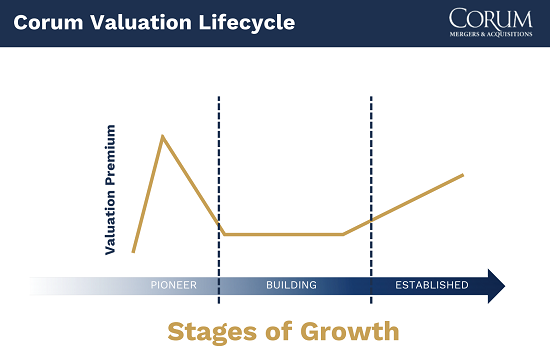

We see companies as they evolve. The graphic below is a way to measure how your valuation will change over time.

Valuation is dynamic. Depending on the phase that companies are in, they will experience differing growth curves that will have a direct impact on their valuation. New market entrants may show up when they’ve demonstrated product-market fit as they try to disrupt the market. Whether a well-funded start-up or market incumbent, a company’s valuation will typically mirror how well they are maintaining product-market fit. You can be at the peak one year and fall to a valley the next. Whether you are creating a new market such as Groupon or are an industry stalwart such as TD Ameritrade, you are faced with managing fast-moving waters in software and technology. Nobody is immune and big companies face the same challenges around growth and relevancy that your company does. Do you have a grow-fast or die-slow mentality, and is this in the DNA of the company and culture? Being ready as CEO will mean that you will have thought this through and understand where your company is on this journey.

Understanding why you’re growing and the hockey stick:

We are on the longest bull run in history for the US stock market. It won’t last forever. When trying to figure out when to sell your business, consider market conditions at a macro level. The graphic below paints a healthy picture of where things are today ― at all-time highs.

And while these macro conditions have an impact on your business both positive and negative, you need to also consider the dynamics of your company’s trajectory. It’s hard to change the growth trajectory. You may be waiting for that disruptive new technology to launch and then try to figure out where on the hockey stick you’re going to sell. Waiting for that hockey stick to materialize is risky business. Things usually take longer than expected and as you’re out in the market, you need to figure out how to sell your product.

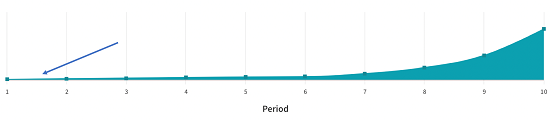

Let’s consider the hockey stick and how that impacts timing of a sales process. When along your growth trajectory should you consider selling, and why does that point in your march to market relevance become a critical milestone?

At the beginning of the hockey stick: Should you sell based on a promise? Depends. Some questions to consider:

- Have you attained product-market fit?

- Is your sales cycle shortening?

- Are you converting a high percentage of leads in your funnel?

- Do you have command of your forecasting process, demonstrably?

- Have you figured out who your customers are and who they are not?

- Is your churn low?

- Do you know why you are churning and retaining customers?

Depending on the answers to these questions, you may want to run a sales process at this point in the trajectory of the business.

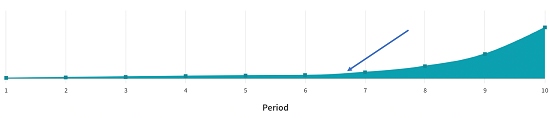

At the middle of the hockey stick: Should you wait a few periods (months/quarters) to see how the launch of the product is going?

If the answer to any of the questions above were no, you likely should monitor the situation on a regular basis to see if there are changes in the business and KPIs that are scalable events. You’ve figured out to how to sell the company’s products, for example, leading to higher close rates and faster acquisitions of customers. Market activities should also be monitored as events such as a competitor being acquired or receiving a large investment could signal whether you should enter the market at this point.

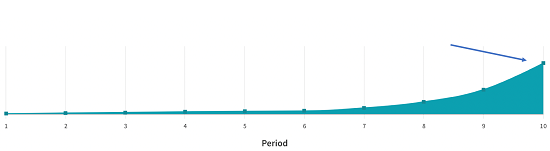

When the hockey stick growth is being realized: You’ve figured out how to run a good business and get and keep customers at scale.

The question here centers around the growth being sustainable. If you wait to sell your company at this point, do you have the tail winds to continue the growth? There is also risk that things are going so well that you decide you don’t need to sell the company now. This actually can be a paradox in technology M&A. Like a great athlete, is it best to sell (or retire) when you are at the top of your game? Money aside, this usually becomes a question of risk. Is the risk of doing nothing the greatest risk of all? You’ll start to experience churn as the hockey stick materializes. You’ll have to be ready to address why you’re winning and why you’re losing with prospective buyers of your business. I’ll look at why high churn rates are normal in fast-growing companies and introduce topics like dormancy rates in a subsequent post.

100 Million Reasons:

I had a former CEO share his story after I led a panel discussion on deal killers at a technology seminar focused on exits. He told me that his goal was to sell his company when he reached $100 million in revenues. The problem was that his company crashed and burned at $50 million. He was advised by his team that they were running out of money to fund growth and he didn’t listen. He kept the peddle on the gas and didn’t heed the warning signs. As warned, the company couldn’t maintain the growth and they ran out of money; the company collapsed. The point is that waiting to sell your company until you reach a specific financial milestone is risky. The market is not standing still, and you run a risk of always chasing the next revenue target only to have the market and technology change – leaving you stranded.

In summary, as CEO, you need to be ready to enter a sales process for the sale of your software or technology business if you want to optimize the outcome. You need to have the right team at your side to guide you through your process. You need to be prepared and you certainly can’t be your own dentist. The CEO’s preparedness is much more than a semblance of documents and preparation of financial information. Preparing to sell is a mindset. You, as CEO, need to be ready to sell your company with an understanding of where your company is in the market and in its own evolution. Moreover, you need to have your stakeholders readied to support you, and you’ll need to accept that the business is its own living, breathing thing, separate from you, that needs fuel to continue to grow.