Joel Espelien

Executive Vice President - Client Services

Contact Info

Seattle

425-455-8281

joele () corumgroup ! com

About

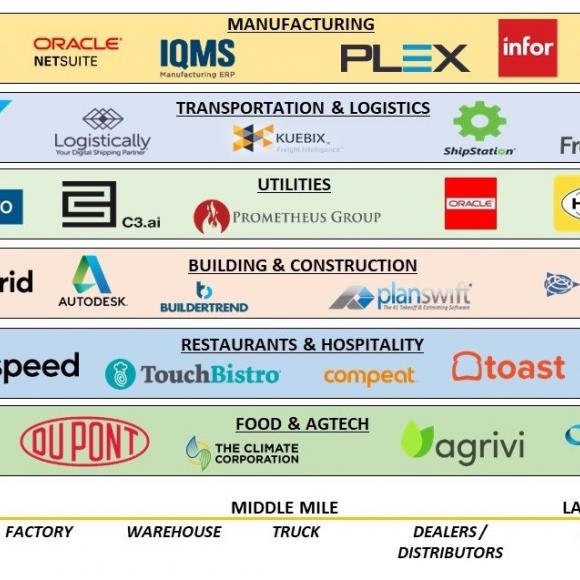

Joel Espelien has worked in a number of roles over a 25-year career in the technology industry and has participated in multiple successful transactions since joining Corum in 2017, including the recent sale of IoT smart logistics company Connected Holdings to Phillips Connect Technologies. Prior to Corum, Joel was involved in many successful technology M&A transactions, including video pioneer DivX LLC (acquired from Rovi and sold to Neulion), pet IoT company Snaptracs, Inc. (acquired from Qualcomm, merged with Whistle Labs, sold to Mars pet food), AI startup IQ Engines (acquired by Yahoo), AgTech IoT leader 640 Labs (acquired by Monsanto/Climate Corporation) and mobile video pioneer PacketVideo (acquired by NTT DoCoMo). Joel started his career as IP and corporate attorney at Cooley LLP in Palo Alto and San Diego, California and is still a member of the Bar in both Washington and California. He holds a JD/LLM (International and Comparative Law) from Duke University and a BA from St. Olaf College. Joel is also fluent in Spanish and has done business throughout Spain and Latin America. Joel is originally from Minnesota, lived for many years in San Diego, California and now resides in the Seattle area.

Joel Espelien on the TechExits podcast.

Insights

October 30, 2019