February 21, 2023

Growth and Exit Strategies: Building for Scale, Building for Sale

February 21, 2023

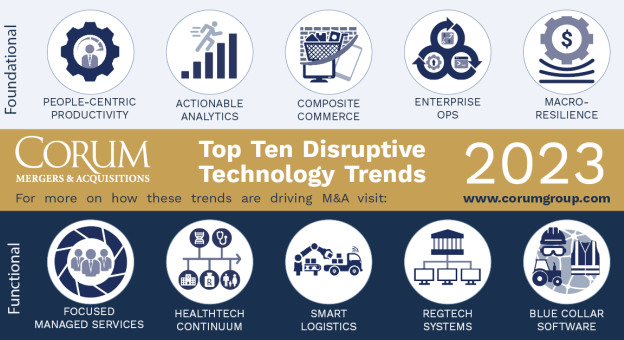

2023 Top 10 Disruptive Tech Trends

December 15, 2022

What Concerns CEOs About Running an M&A Process

December 14, 2022

Raise or Merge?

November 16, 2022

Corum Advises Retail Consult in Transaction with Gyrus Capital

September 20, 2022

Corum Advises PeopleInsight in Acquisition by HireRoad

September 20, 2022

Corum Advises Webshare in Acquisition by Oxylabs

September 7, 2022

Why American Buyers Will Continue to Dominate