Your AI Strategy Isn’t a Cliffhanger—It’s a Clock

Executives often compare artificial intelligence to electricity; the difference is that AI arrived on a runway already built, so adoption went vertically in record time. Cloud platforms, powerful GPUs, mobile distribution, and enterprise data flows let machine learning and generative AI move from lab to line-of-business in a single planning cycle, and the numbers reflect that shift—large surveys this year show executives ranking AI as central to competitiveness and budgeting for expansion even as they admit to risk, uncertain ROI and governance gaps.

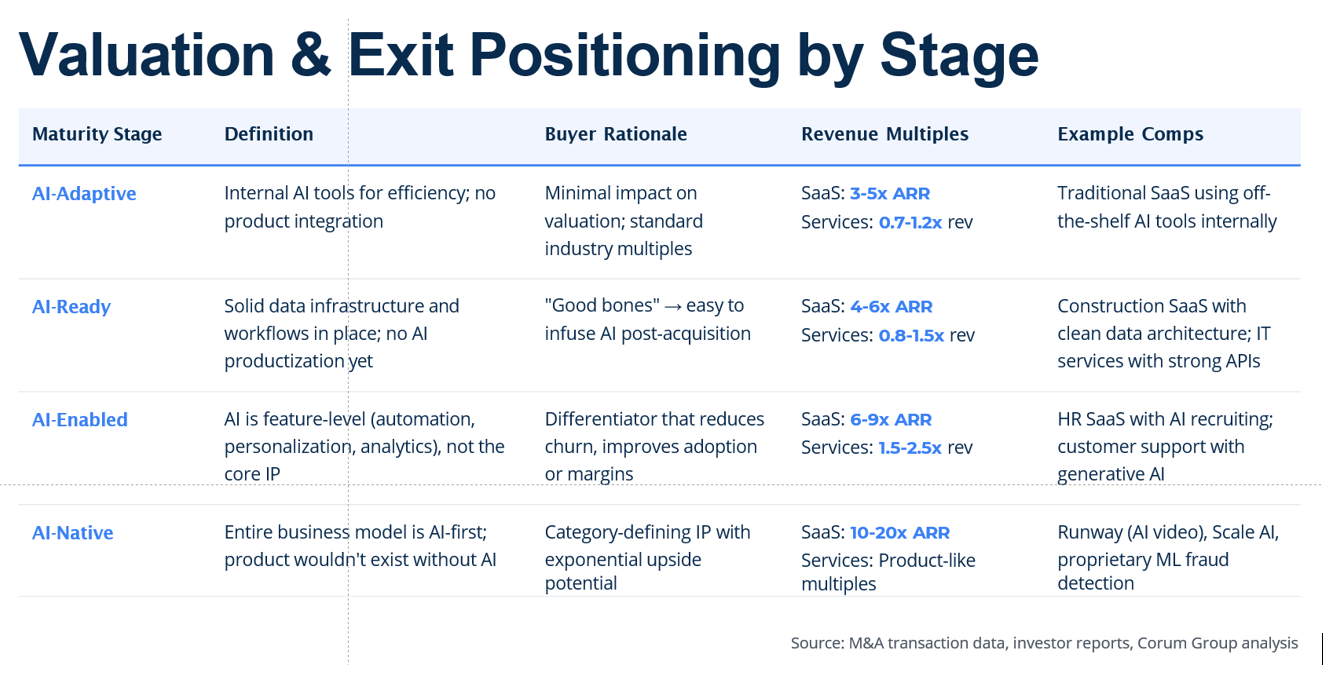

Markets are putting prices on those beliefs. In technology and beyond, buyers are bidding up companies that can prove AI is a core operating advantage, not a feature announcement. Enterprise software shows the clearest two-track regime: AI-native platforms are getting 15–20x ARR in select deals and comps, while strong traditional peers sit closer to mid‑single‑digit to high‑single‑digit revenue multiples.

Mid‑market buyers describe a re‑rating effect when AI drives measurable operating gains, and M&A advisors now treat proprietary models and data assets as IP that can justify step‑ups at exit.

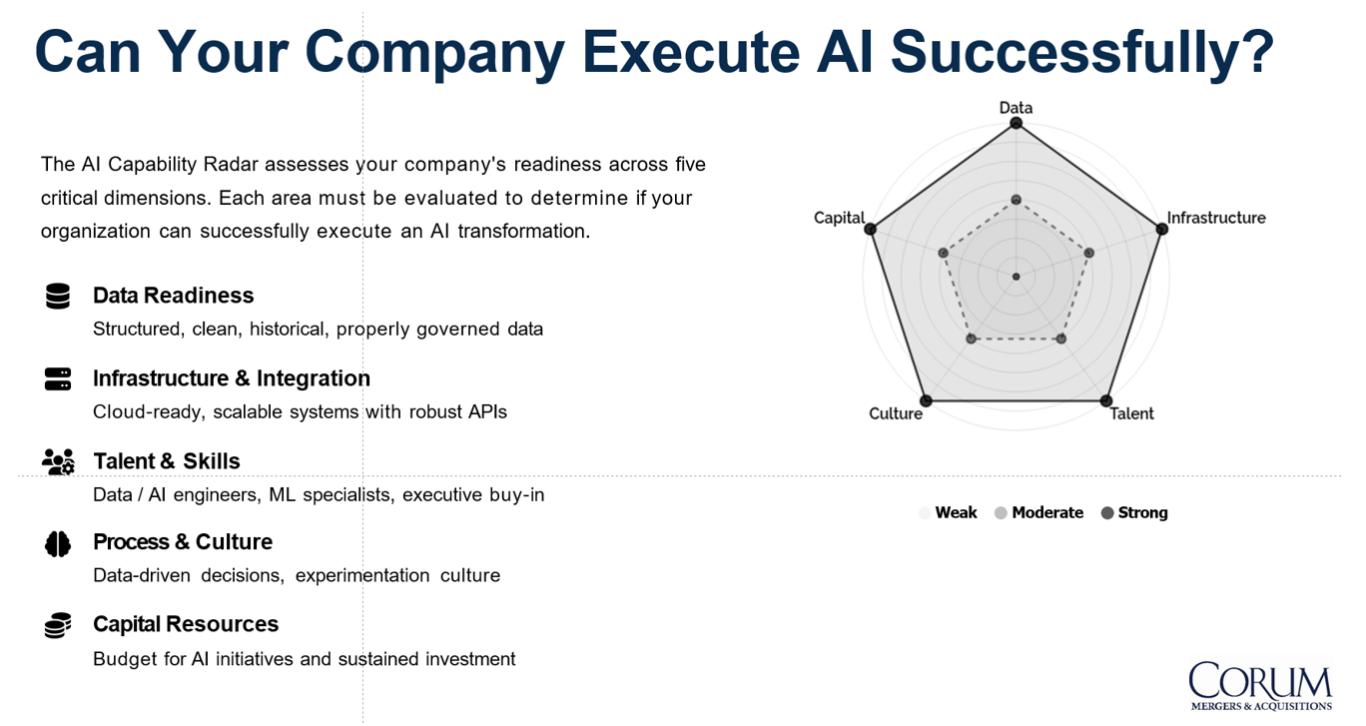

That premium creates a decision founders can’t park in committee. Time is not their friend. The path to higher value runs up a maturity ladder—adaptive pilots, readiness alignment, broad enablement, and finally native operating design—yet most firms stall in the middle because the hard parts are not demo days; they’re infrastructure, data unification, and organizational change at speed.

Here’s a simple screen that has saved time and money: five gates the company must pass before committing to a true AI build. First, data: is it consolidated, reliable, and accessible across products and functions, or still trapped in silos and contracts that slow progress? Second, infrastructure: are systems interoperable and cloud-forward with clean interfaces, or burdened by brittle stacks that double timelines and bills? Third, talent: is knowledge concentrated in a few specialists, or distributed into leadership and product teams able to design AI-first workflows? Fourth, process and pace: does the organization reward testing, small-batch releases, and rollbacks, or document, defer, and defend the old map? Fifth, capital: are budgets aligned to the real costs of data work, model operations, guardrails, and change management, or premised on slogans and a single fiscal year?

If the answer is “yes” across those gates, the economics of building toward AI-native can work—especially in software, where the multiples gap is widest and measurable AI-driven margin expansion shows up in bids and LOIs (Letters of Intent).

If the answer is “no” on more than one, the rational play often shifts to exit timing, because markets still pay for credible potential today but will not do so indefinitely as AI becomes the expected norm rather than exceptional. Private equity notes the same pattern in industrial and services deals: real automation, cost takeout, and defensible data loops earn a step-up in valuation; folk tales do not.

The temptation for an entrepreneur to wait is always strong—revise a plan, launch another product, launch another pilot. Yet hesitation carries a cost few firms can recover once customers reset expectations and acquirers narrow their filters. Surveys show adoption pushing ahead even as enterprises grapple with governance gaps, which means the competitive bar rises whether a board resolves its debates or not, and capital markets tend to close premiums faster than leadership teams can retool their operating rhythms.

There’s the economy to consider as well. Higher rates and tighter budgets reduce tolerance for long reinventions that don’t ship results, and that backdrop favors companies with the assets and urgency to sprint, or those with the discipline to sell on strength rather than after erosion sets in.

None of this argues for panic; it argues for clean decisions supported by the evidence in front of every board: AI adoption is climbing, premiums are concentrated in the AI-enabled and AI-native camps, and a buyer universe that is getting more discerning by the quarter.

In plain terms, a founder’s options are twofold: commit to the AI build with the right foundations or exit before the story cools. The only losing move is to treat AI like a cliffhanger on Netflix that resolves itself next quarter, because in this market it is not a cliffhanger, it is a clock.

Sources:

- McKinsey & Company | Superagency in the workplace: Empowering people to unlock AI’s full potential

- IBM | AI Spending Expected to Surge 52% Beyond IT Budgets as Retail Brands Embrace Enterprise-Wide Innovation

- AI Magazine | NTT: How Global CEOs Are Planning For an AI Investment Surge

- EY Global | Why agentic AI is a revolution stuck in an evolution

- Exploding Topics | 50 NEW Artificial Intelligence Statistics (July 2025)

- EY Global | CEOs bet big on generative AI to gain competitive edge despite hurdles to adoption and M&A challenges

- The “AI Premium” in Private Equity Deals: Why Automation is Boosting Valuations Across Industries

- FINRO | M&A in AI: 2025 Valuation Multiples and Key Trends

- Aventis Advisors | AI Valuation Multiples 2025

- L40 | AI Valuation Multiples: Most Valuable Industries in 2025

- Forbes | To Be Or Not To Be ‘AI-Native,’ That Is The ‘Only’ Question

- EisnerAmper | How AI Is Shaping the Valuation of Private Companies

- Bain & Company | AI Survey: Four Themes Emerging

- Vivatech | The AI Advantage: Tech Competitiveness in a Global Market

- Corum Group | Ivan Ruzic

- SM 2024 | Strategic Management and Decision Support Systems in Strategic Management

- JSTOR | The Art News, Vol. 21, no. 35

- Economic and social development : 61st International Scientific Conference on Economic and Social Development

- AAAL Portland 2017

- AVS Quantum Science Workshop Room B110-112