Venture Capital Has Dried Up

A common theme among tech companies is that venture capital has become much harder, if not downright impossible, to obtain over the past 2 years. Even promising tech companies with strong growth, perfect metrics, great products and established customer bases are having an incredibly difficult time raising money. For others – and this includes very good companies that nevertheless may have stumbled in one area or another, or are facing real, but surmountable challenges, the chances of raising VC right now are somewhere between slim and none.

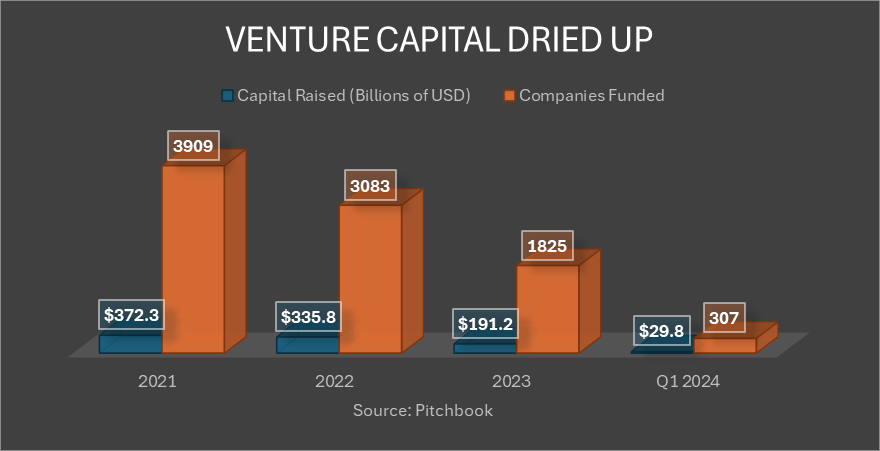

Don’t be so hard on yourself. It’s not you, and it’s not your company; this is a global phenomenon. Here are some key statistics highlighting how bleak the current situation is for venture capital.

First, a quick review. Just 3 years ago in 2021, according to Pitchbook, venture capital raised $372.3 billion and funded 3,909 companies. The COVID boom saw investors throw gobs of money at startups that looked like they might benefit from the massive disruption caused by the pandemic – gaming, telehealth, remote work, etc. Think GameStop, Robinhood, Peloton and Zoom. Of course, some of these business plans were questionable to say the least, but with zero interest rates and massive amounts of liquidity in the system, venture investors went on a binge. The proliferation of meme stocks and SPACs during this period, most of which proved to be horrible investments, is an obvious tell that this was basically a bubble.

By late 2021, reality began to sink in as public markets turned lower on fears of runaway inflation and the winding down of government stimulus packages. When the US Federal Reserve started aggressively raising interest rates in March 2022, the cost of capital rose substantially and continued to rise alongside subsequent rate hikes. The era of “free capital” came to a rapid and unceremonious end. This shift has dramatically affected venture capital.

In 2022, venture capital raised $335.8 billion, down 10% year-over-year, and funded 3,083 companies, down 21% year-over-year. Remember that much of that capital was already committed Q4 2021 and Q1 2022 before major inflationary problems reared their ugly head. Geopolitics obviously haven’t helped. The Russian invasion of Ukraine in February 2022 has kept oil and other commodity prices high which in turn kept inflationary elevated, prompting more rate hikes as a policy response.

By 2023 the chickens really started to come home to roost. Venture capital raised just $191.2 billion, down 43% year-over-year, and the number of companies funded collapsed to 1,825, down 41% year-over-year. While that seems bad, 2024 has gotten even worse. So far, venture capital firms have raised just $29.8 billion and funded just 307 companies (many of which are crowded trades around AI). Going forward, there is no near-term light at the end of the tunnel as the US navigates a difficult election year while wars continue to rage in Ukraine and the Middle East. For all but the biggest or hottest unicorns, the VC market is for all intents and purposes closed.

With venture capital no longer a viable option, entrepreneurs are left with two main choices – go back to bootstrapped growth or find the right growth partner via M&A. Fortunately, the tech M&A market is thriving, offering companies lots of alternatives among strategic and financial (e.g. private equity) buyers.

If your company has raised VC in the past, or you were planning on raising this year, consider reaching out to Corum to explore all of your options. If you’ve got all your eggs in the VC basket right now, you need look for another basket.