Rule of 40

One of the metrics that financial and strategic investors commonly use in assessing the attractiveness of a software company is the Rule of 40. The Rule of 40 states that the sum of a company's annual growth rate plus it profit margin should equal or exceed 40%.

Software companies that meet or exceed 40% are generally seen as attractive investment targets, while companies that don’t meet that threshold generally are not. Profit margin in this case refers to EBITDA margin, where EBITDA is earnings before interest, taxes, depreciation, and amortization; and EBITDA margin is EBITDA divided by total revenue times 100 (in mathematical terms, EBITDA margin = EBITDA/revenue x100).

For example, suppose a company has an annual growth rate of 20% and an EBITDA margin of 30%. The sum of its growth rate and EBITDA margin is 50%, which meets the Rule of 40 requirement.

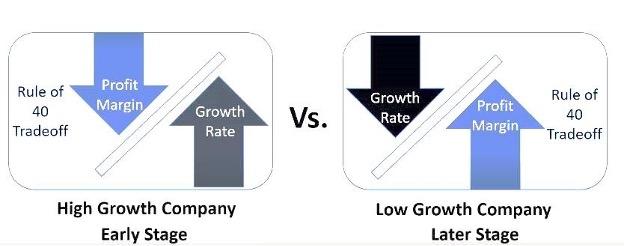

In essence, the Rule of 40 balances growth and profitability, recognizing that companies typically prioritize either one or the other depending on their stage of maturity. For example, early stage companies generally have high growth rates and low profit margins because they're building their business by reinvesting their profits into sales, marketing, and other operational areas. At the other end of the spectrum, mature companies often have low growth rates, but can have high profit margins because they're not plowing as much money back into the operation of their business.

Both types of companies can be attractive M&A targets to potential buyers from a Rule of 40 perspective.

Let's look at two examples:

- Early Stage Company:

| 2022 | 2023 (Projected) | |

| Total Revenue | 1,069,212 | 2,019,523 |

| Gross Profit | 374,224 | 868,395 |

| Gross Profit % | 39.9% | 43.0% |

| EBITDA | 261,540 | 457,698 |

| EBITDA Margin | 24.5% | 22.7% |

| Annual Growth Rate | 88.9% | |

| Rule of 40 Sum | 111.6% |

- Mature/Late Stage Company:

| 2022 | 2023 (Projected) | |

| Total Revenue | 5,432,812 | 6,218,550 |

| Gross Profit | 4,667,250 | 5,347,769 |

| Gross Profit % | 85.9% | 86.0% |

| EBITDA | 1,361,269 | 2,464,028 |

| EBITDA Margin | 24.5% | 39.6% |

| Annual Growth Rate | 14.5% | |

| Rule of 40 Sum | 54.1% |

Both companies meet the Rule of 40 threshold.

The importance of the Rule of 40 goes beyond its indication of a company’s health. Corum has seen companies that meet the Rule of 40 receive much higher valuations than companies that do not ‒ in some cases valuation increases as high as 154%. In other words, software companies that meet the Rule of 40 are getting valuations more than double of what they would otherwise receive.

The Rule of 40 can also be a helpful guide to company executives. Calculating the Rule of 40 value for a company can indicate where additional resource allocation or funding should go. For instance, say the company’s Rule of 40 score is below the 40% threshold. The calculation can help the company’s executives decide what part of the equation needs strengthening – growth rate or profit margin – and take actions to meet that goal.

Another thing to keep in mind is that meeting the 40% objective is no assurance that a software company is an attractive investment target. A company can reach or exceed the 40% score even with a negative growth rate or profit margin. For instance, consider a company that has an EBDITA margin of 50% and a negative growth rate of -5%. This is quite possible for a very mature, highly profitable company. Their score would be 45%, meeting the Rule of 40 requirement. But it’s questionable whether a company that is shrinking like this one would be attractive to investors.

Conversely, a software company can be an attractive investment target even if it does not meeting the Rule of 40. Other factors such as strategic relevance and future potential also play a role in investors deciding whether a software company is an attractive target or not. While meeting the Rule of 40 threshold is a good objective for a software company, what’s really important is ensuring that a prospective investor views that company as an excellent fit for their strategy and future plans.