Major Tax Changes for US Software Companies

Recent changes to the US federal tax code have major implications for tech companies operating in the United States, particularly as it concerns accounting for software development costs. Prior to the amendments to Section 174 that were adopted with the passage of the Tax Cuts and Jobs Act (TJCA) of 2017, expensing R&D costs associated with developing software created an effective way for enterprises to reduce taxable income. The reduced corporate tax burden enabled tech companies to invest more of their cash flows towards their operations and growth story.

Historically, Section 174 of the US Internal Revenue Code stipulated that enterprises could deduct any research or experimental expenses from their taxable income in the period where these costs were incurred or paid. This encouraged tech firms with operations in the US to invest in R&D as those expenses reduced their near-term tax liabilities.

In the wake of the TJCA bill becoming law in 2017, companies operating in the US had to treat R&D expenses differently for tax purposes starting in 2022. These rule changes for R&D expenses are applicable to C-Corps and pass-through entities such as S-Corps and LLCs.

Guidance covering Section 174 was issued in September 2023 that explicitly called for software development costs to be treated as R&E expenses that are subject to capitalization rules. Section 174(c)(3) states that “any amount paid or incurred in connection with the development of any software shall be treated as a research or experimental procedure.” This rule change stipulates that US-based software development expenses must now be amortized over five years while international R&D expenses must now be amortized over 15 years due to these costs being capitalized.

Effectively, this rule change was designed to encourage enterprises to shift software development activities and the related expenses to the US due to the more favorable tax treatment. The new rules impacted the 2022 tax year, with the IRS allowing software development costs to be fully expensed during the first half of the tax year and amortized under the new rules during the second half.

Relevant R&D costs impacted by changes to Section 174 include:

- Software development planning, including documentation of the software requirements

- Designing and architecture activities, including upgrades to software

- Building a software model

- Writing source code

- Testing software and adjusting that software as needed to optimize performance and fix technical errors

- Production of the product master(s) under certain conditions

Expenses not subject to this clarification provided by the IRS include data conversion, software installation and configuration, training, business process re-engineering, maintenance, database, customer support and distribution-related activities.

Companies that rely heavily on non-US software development resources are more exposed to the adverse effects these tax rule changes will have versus their peers that primarily develop software in the US. Going forward, the requirement that software development costs must be amortized over the relevant period will have a profound impact on smaller tech companies as it will effectively reduce the amount of operating costs that can be deducted from their revenues, potentially increasing their federal tax liabilities or creating a tax liability. This will drain resources from companies, especially smaller firms with limited financial resources, due to the effective tax increase and make it harder for enterprises to invest in their operations and growth story.

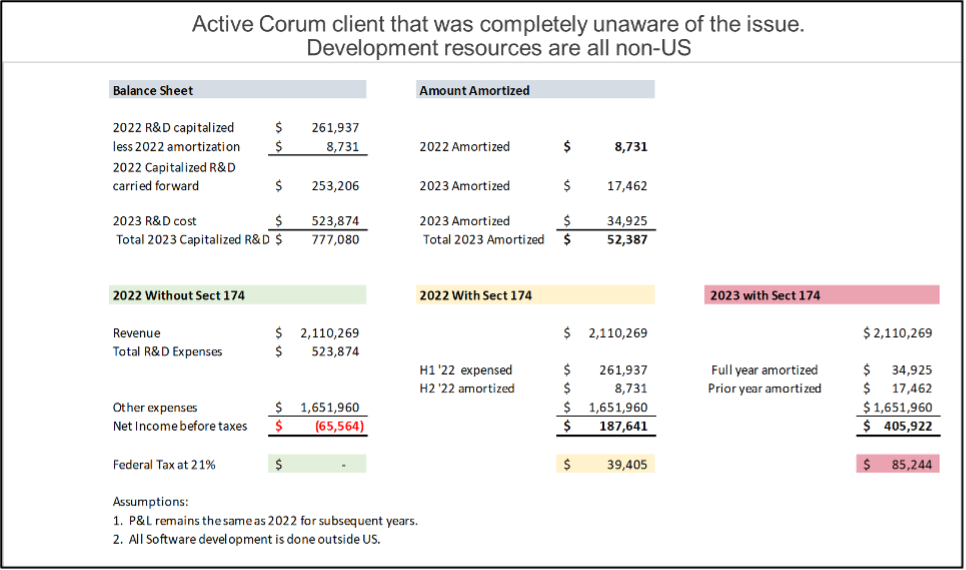

Here’s an example of the impact that changes to Section 174 are already having on an active Corum client that has all its software development resources located outside of the US. Under the old rules, the firm could have expensed over $0.5 million in R&D expenses in 2022, a figure that falls below $0.3 million when using the special rules for that year (half fully expensed, half amortized). If the company spent a similar amount on R&D outside of the US in 2023, under the 15-year amortization schedule those expenses would have been less than $60,000.

An illustrative example of how changes to Section 174 can impact your business

Changes to Section 174 saw this firm’s loss flip to a profit in 2022 under the new rules, resulting in the company generating taxable income and a related federal tax liability for that period that management was not expecting. Quite the shock. These changes are mandatory, every firm operating in the US must adhere to the new rules laid out by the TJCA of 2017 and enforced by the IRS.

Some US states follow federal tax guidance while others don’t, which is why you need to consult a tax advisor for the specifics of the policies in each state to remain in compliance with the law. Furthermore, to properly reflect expenses that pertain to Section 174, effective and accurate time tracking efforts need to be implemented across all of your company’s R&D activities.

Using R&D tax credits, under Section 41 of the federal US tax code, can help offset tax burdens that arise from changes to Section 174. Make sure that when your company is filing for an R&D tax credit in the US that software development costs are capitalized appropriately, or else you risk getting audited by the IRS, something that’s best avoided under any circumstances.

Furthermore, companies sitting on large net operating losses that intend to use those to offset future tax liabilities should be warned that NOLs can be used to offset only 80% of tax liabilities after amendments were made to the relevant tax rules under the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2021. There is no way for any enterprise to avoid this major tax rule change over the long run.

As it concerns PE firms, they will want to see income statements with R&D fully expensed to gauge the company’s cash EBITDA or free cash flow. If the R&D is capitalized, they will fully expense that figure to get the desired metrics. Ensuring that you are providing the appropriate financial statements to different entities is paramount.

On January 16, Democrats and Republicans in Congress announced a major bipartisan compromise that would effectively undo the aforementioned changes to US-based R&D expense accounting for tax purposes. This culminated in bill H.R. 7024, which passed the House of Representatives by a wide margin on January 31 with substantial bipartisan support. The $78 billion bill is known as the Tax Relief for American Families and Workers Act of 2024 and covers a lot of ground including business taxation rules, child tax credits and other considerations.

While the provisions within this bill have yet to become law, it appears that Congress listened to business leaders, including Corum, and agreed that recent changes to Section 174 would have a detrimental impact on innovation in the US. We caution that the proposed tax changes in H.R. 7024 won’t materially impact how international R&D expenses are treated for US tax purposes under current rules.

Call your senators to encourage them to get to work on making bill H.R. 7024 become law and call your representatives to ensure that this bill gets over the finish line. Getting H.R. 7024 passed would remove a major burden on software developers.