Do Have Time For A Deal?

If you have time for 1, you have time for 100.

You've been approached by a potential acquirer. What should you do? Should you take the call? Sign the NDA? Share financial information?

The likelihood that a strategic or financial buyer has approached you is high, given the current overall market activity. The market is hot. You need to play the inbound interest very carefully, though. If it's a competitor, do you really want to open the kimono if you're not ready and haven't spoken with the entire market to calibrate value and structure?

I've seen CEOs try to manage this inbound interest themselves and fail regularly. They figure that they'll test the waters and gauge the value of their company. Wrong. If you are talking to one buyer or trying to manage the process yourself, you are putting yourself in a weak position.

If you've attended any of our events, you'll recognize the viewpoint that one buyer is no buyer. The probability that you'll actually close a transaction with one buyer at the table is low. The math is not in your favor. Eleven percent of the time, inbound interest in acquiring your business results in a transaction, and seventy-five percent of the time, there is another buyer out there who will pay more.

A buyer will also know that if you are trying to manage a process yourself, the maximum number of buyers that you can talk to is two, maybe three. There is no way to run an effective process yourself and still manage your business. Buyers know this and leverage it to their advantage.

So why only talk to one buyer? Why not increase your probability of attaining an optimal outcome with a global process? Let’s examine the time required to speak with one buyer versus the time needed to speak with 100 buyers through a global process.

Self-Managed Process:

If you were to attempt to manage the process yourself, the estimated time required is shown in the table below. The amount of time required and typical steps are indicated below: from an introductory phone call through negotiating and signing an LOI with one buyer. Phone calls, deck preparation, buyer presentations, meetings with your team and your board and LOI negotiations would take an estimated 42-84 hours.

| Stage | Min | Max |

| Intro phone Call | 1 | 3 |

| Follow up Phone Call | 1 | 3 |

| Deck Preparation | 12 | 20 |

| Buyer Presentation | 2 | 4 |

| Follow Up Phone Call | 1 | 2 |

| Internal Meetings with Team | 10 | 20 |

| Buyer Meetings | 4 | 10 |

| Board Meetings to Discuss M&A | 1 | 2 |

| Negotiate LOI | 10 | 20 |

| Total | 42 | 84 |

Professionally Managed Process:

For a professionally managed process, the steps in which the CEO participates are identified below. The amount of time is equivalent to a self-managed process for the ability to get your company in front of 80 to 100 buyers.

| Phase | Stage | Metric (Hours) | Min | Max | Weeks |

| Preparation | CEO Worksheet | 2 | 3 | ||

| Preparation | IPM Meeting | 3 | 4 | ||

| Preparation | Travel | 4 | 6 | ||

| Preparation | Document Review | 8 | 10 | ||

| Preparation | Management Presentation | 4 | 8 | ||

| Outreach | Weekly Status Updates | 0.5 | 5 | 10 | 10 |

| Outreach | Management Presentation + Debrief (3-10 Presentations) | 1.5 | 4.5 | 15 | |

| Discovery | On-Site Meetings with Buyer(s) | 4 | 20 | ||

| Discovery | NDA Review and Signing | 0.333 | 2 | 4 | |

| Negotiations | LOI Negotiation | 4 | 10 | ||

| Total | 40.5 | 90 |

Timeline:

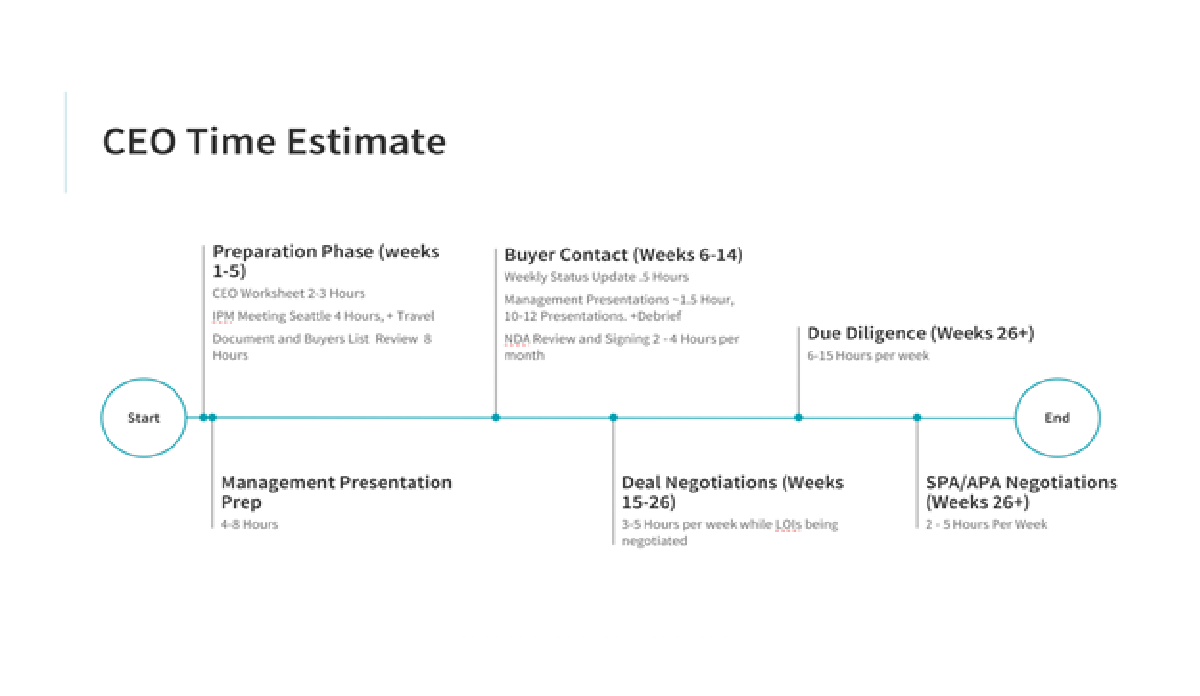

How much time do you estimate it will take for a CEO to run a process from preparation to close? The timeline below outlines the steps in a professionally managed process, including due diligence and SPA/APA contract negotiations. You should budget 38 to 74 hours for the preparation, outreach and deal negotiation phases. For due diligence, 6-15 hours per week is reasonable, and you'll likely have other team members, such as your CFO, working with you. Finally, the SPA/APA negotiations in the latter part of the process will likely require up to 2-5 hours per week during the time the deal documents are negotiated.

If you look solely at the amount of time you'd invest in selling your company through a self-managed process, versus running a professional process with the ability to reach 80 to 100 companies, you can see that the time required is equivalent. You significantly tilt the numbers in your favor by increasing the number of buyers by a factor of 80 to 100 in a professionally managed process. This is a no-brainer.