March 26, 2024

Cow Corner has Acquired Controlling Interest in Corum Client Glider

March 4, 2024

Insights from Corum Dealmaker Rob Wellman

January 28, 2024

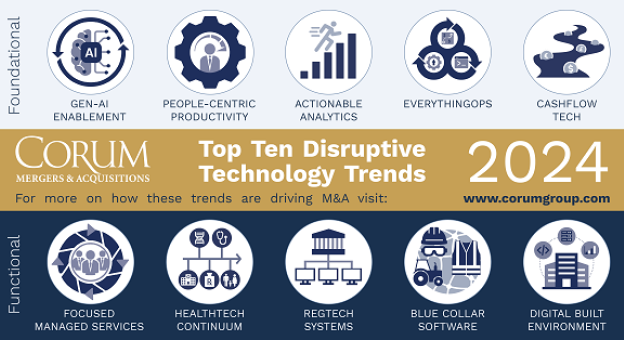

2024 Top 10 Disruptive Tech Trends

January 7, 2024

The Closing Statement – What You Need to Know

January 3, 2024

Major Tax Changes for US Software Companies

December 11, 2023

Dura Software Acquires Infinity Software Holdings

December 5, 2023

Merger-Market Fit

December 4, 2023

Peoplesafe Expands Global Reach with Acquisition of Corum Client OK Alone