Incentivizing sellers through profit-sharing or options essentially works the same way that it does with employees: it serves as a motivational tool to help the company hit its sales targets, while keeping everyone focused on efficiency. In M&A deals, the profit targets can be linked to the seller company’s own targets, or to the performance of the company at large.

Buyers will always say that they want to make full pay-outs in these cases, as that shows the deal was a success. After all, the ultimate goal of any M&A deal is driving a higher profit. However, sellers should be cautious when the weighting of the deal is too focused on profit sharing or options in order to “bridge the gap on valuation”. First of all, achieving profit targets can be out of the seller’s control, meaning that the seller hits his or her targets, but the overall targets are not met and therefore there is no payout.

Buyers will always say that they want to make full pay-outs in these cases, as that shows the deal was a success. After all, the ultimate goal of any M&A deal is driving a higher profit. However, sellers should be cautious when the weighting of the deal is too focused on profit sharing or options in order to “bridge the gap on valuation”. First of all, achieving profit targets can be out of the seller’s control, meaning that the seller hits his or her targets, but the overall targets are not met and therefore there is no payout.

Another possible reason for concern is the mixed incentives of such plans, when profit sharing is linked to the seller’s performance. Even if the goal of both sides at closing is to achieve the highest profits in the company, things can change. An example from a former client here in Europe involved the buyer being acquired themselves—the new owner had no interest in the business involving the seller’s solutions. Unfortunately, this made it impossible for the seller to hit his payout targets.

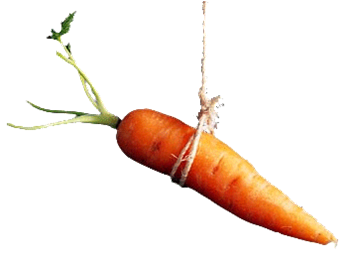

Where we do see profit-sharing or options work is when they are used as a  carrot on top of the deal, keeping the seller motivated to stay on board and perform, and justly rewarding them for doing so.

carrot on top of the deal, keeping the seller motivated to stay on board and perform, and justly rewarding them for doing so.